[Press Release] HF Supports Customers’ Economic Recovery and Restart

- Date 2025-07-31

- Views 203

HF Supports Customers’ Economic Recovery and Restart

- Principal repayment postponed for Bogeumjari & Conforming Loan customers, small business owners, and families with multiple children

- Debt reduction expanded for committed but overdue Home Guarantee repayers

Korea Housing Finance Corporation (HF, CEO Kim Kyung-Hwan) announced on July 31 that, starting August 1, it will implement a debt adjustment program aimed at supporting the financial recovery and restart of customers experiencing repayment difficulties. This initiative is available to those using Bogeumjari Loans, Conforming Loans, Jeonse Deposit Guarantees, and other HF-guaranteed products.

Principal repayment postponed, etc., for Home Pension and Conforming Loans

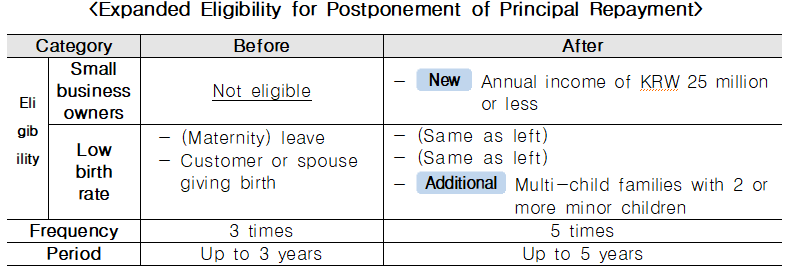

Customers with Bogeumjari Loans or Conforming Loans who are facing difficulties repaying the principal and interest can apply to postpone principal repayment* once a year and up to five times over a 5-year period.

*This program allows borrowers who are temporarily struggling financially to defer principal payments and only pay interest.

Eligible applicants include ▲ those who are unemployed, on leave, experiencing business closure, or temporarily out of work; ▲ households with income reduced by over 20% compared to the previous year; ▲ families with two or more children under 19; and ▲ small business owners with annual income below KRW 25 million.

For customers whose overdue payments have persisted for more than 2 months and who have lost the right to benefit from the loan, repaying the overdue principal and interest will result in a reduction of late fees. In particular, for vulnerable groups such as disabled individuals, multi-child families, multi-cultural families, and basic livelihood recipients, late payment penalties may be completely waived (one time only).

For customers with overdue principal payments who have not yet lost the right to benefit from the loan (i.e., overdue for less than 2 months), they can simultaneously apply for the postponement of principal repayment and reduction of late fees, significantly reducing their financial burden.

Special debt adjustment campaign for Home Guarantee product customers

HF will run a Special Debt Adjustment Campaign* for Jeonse Deposit Guarantee and other Home Guarantee product customers who are unable to repay their loans and whose debts have been paid off by HF to financial institutions. This program will run until November and provide various incentives, such as higher debt reduction rates for customers who have repaid their loans faithfully over a long period.+

* This program temporarily eases debt adjustment terms to support customers’ economic recovery, with special benefits for those who have demonstrated long-term repayment discipline.

Customers who have been repaying their loans in installments for over a year can receive a 5% reduction on remaining subrogation claims* and up to a 30% reduction on written-off debts** if they repay the remaining debt in full.

* Subrogation claims: Claims HF must recover from the customer after paying the debt to the financial institution on their behalf

** Written-off debts: Non-performing loans that have been written off as a loss due to anticipated difficulty in recovering the claim from the customer

To facilitate installment repayment agreements, ▲ the initial payment requirement has been relaxed from 5% of the principal to just the first installment payment, ▲ for an installment repayment agreement that has been made but the repayment plan was not followed, the agreement will be reinstated still under the same terms even if only the first overdue payment is made, and ▲ the repayment period will be extended from the original 10 years to a maximum of 20 years, thus reducing the debtor's repayment burden and allowing for quicker removal of credit management information.

For customers with small written-off debts (under KRW 5 million), including seniors over 70 years old, basic livelihood recipients, and disability pension recipients, up to 99% of their debt will be forgiven to support their financial recovery. Additionally, small business owners, young people, and residents of special disaster areas will be eligible for up to 80% debt reduction to aid in their recovery.

For more details, customers can contact the HF call center at 1688-8114 or visit any HF branch. Applications for the Bogeumjari Loan debt adjustment program can also be made through the HF website* or the Smart Housing Finance App. However, Conforming Loan applications must be made through the bank where the loan was originally taken out.

* Refer to HF Website: www.hf.go.kr > Housing Loans → Individual Debt Protection → Postponement of Principal Repayment.

HF CEO Kim Kyung-Hwan said, “We hope that this program will provide practical assistance to customers struggling with debt repayment during these difficult economic times. We are committed to continuing to prioritize and support faithful repayers while lowering the barriers to debt adjustment and helping customers with their financial recovery.”