「2022 Survey on Housing Finance and Bogeumjari Loans」: Results

- Date 2023-04-05

- Views 147

「2022 Survey on Housing Finance and Bogeumjari Loans」: Results

- Growing preference for fixed-rate and ultra-long-term mortgages amid rising interest rates

1. Survey Overview

Korea Housing Finance Corporation (HF, CEO Choi Joon-Woo) announced the results of the 2022 Survey on Housing Finance and Bogeumjari Loans on the 5th. HF carried out the survey jointly with a survey agency to examine the nation’s housing finance trends.

ㅇ Conducted on an annual basis to identify consumers' awareness on and needs for housing finance, this year’s survey examined ▲ trends in housing finance usage, ▲ intention to purchase a home, ▲ inclination to use housing finance services, and ▲ trends in Bogeumjari Loan usage.

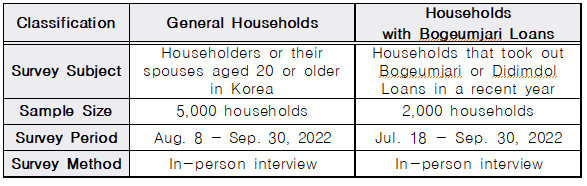

Survey Details

2. Survey Results: Trends for General Households

The survey results revealed that 70.3% of respondents expressed the need for a single-family home for living purposes, showing a slight increase from the previous year's 65.3%. Similarly, 38.0% of respondents indicated their intention to buy a home, which remained consistent with the previous year's 37.2% [see Tables 1 and 2 for details].

For Mortgage Shoppers, Interest Rates and Loan Limits are the Most Important Factors, Followed by Fixed vs. Adjustable Rate Options

When using a mortgage loan, borrowers place a high priority on ▲ the interest rate and ▲ the loan limit. Following these, they were found to be concerned about ▲ whether the interest rate is fixed or variable, as well as ▲ the loan maturity [see Table 4 for details].

ㅇ Furthermore, in terms of prospective mortgage borrowing, borrowers exhibited a preference for fixed rates (49.0%) over adjustable rates (16.9%). The primary rationale behind favoring fixed rates was the desire to secure a consistently low loan rate, especially in the event of market interest rate increases, as indicated by 35.2% of respondents [see Tables 5 and 6 for details].

Strong Borrower Preference for Fixed-Rate Mortgages, Even at a 1.0%p Premium over Variable Rates

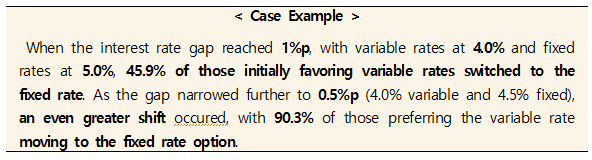

ㅇ Additionally, the study revealed that as the interest rate gap between fixed and variable rates reduced from 1.25 to 1.0 percentage points, there was a notable rise in the percentage of individuals favoring fixed rates. With the interest rate difference contracting to within 0.5 percentage points, the majority of borrowers with variable rates switched to fixed rates [see Table 7 for details].

ㅇ In the meantime, a significant 44.4% of young adults and newlyweds expressed their plans to utilize ultra-long-term mortgages with a maturity of 40 years or more. The primary driving factor behind this preference was the aim to alleviate the weight of monthly principal repayments, with 53.4% highlighting this reason [see Table 8 for details]. Furthermore, the inclination to make use of the youth rental fund guarantee, which offers a more favorable guarantee limit in contrast to alternative products, surged to 55.6% among young households without housing. This marks a notable increase from the preceding year's figure of 45.8% [see Table 9 for details].

3. Survey Results: Households with Bogeumjari or Didimdol Loans

State-Sponsored Mortgage Holders Discover Relief and Satisfaction Amid Interest Rate Increases

The survey revealed a remarkable year-on-year increase of 5.1 percentage points in satisfaction with HF mortgages and Didimdol Loans, reaching a record high of 94.5% [see Table 10 for details]. Additionally, the likelihood of recommending these products to others also grew by 2.8 percentage points compared to the previous year, now standing at 89.6% [see Table 11 for details].

ㅇ The major cause of satisfaction was ▲ the stability of interest burden despite market rate changes. Respondents also valued ▲ the product's affiliation with a public institution, ▲ the option to divide the loan principal into manageable monthly amounts, and ▲ the extended 40-year loan maturity.

ㅇ Moreover, 92.4% of respondents found relief in reduced principal burdens* by using ultra-long-term home equity loans, benefiting their household finances. Of the surveyed, 72.7% said that those savings primarily go toward covering essential living expenses like food, taxes, and communication [see Table 12 for details].

* Choosing extended loan terms leads to significant monthly repayment savings. For instance, for a KRW 300 million loan, borrowers can save a monthly KRW 170,000 (40-year term, KRW 1.29 million monthly payment) and KRW 250,000 (50-year term, KRW 1.21 million) compared to the 30-year term (KRW 1.46).