2019 Survey on the Use of Housing Finance and Bogeumjari Loan

- Date 2020-03-26

- Views 265

2019 Survey on the Use of Housing Finance and Bogeumjari Loan

- 36.2% of those surveyed have a home loan (with the figure higher for households in higher-income brackets).

- 87.1% of those surveyed say it will help address social issues to ease the eligibility requirements for home loans available only to young people, newlywed couples, and families with three or more children.

- 68.8% of those surveyed say that a jeonse and monthly rent loan guarantee product tailored to youth will help reduce housing costs for young people.

- 81.4% of those surveyed understand that long-term, fixed-rate, amortized conversion loans keep household debt in check.

- Bogeumjari Loan users are found to be satisfied with the loan product because of its reliability as a product offered by a public institution and its monthly principal repayment option.

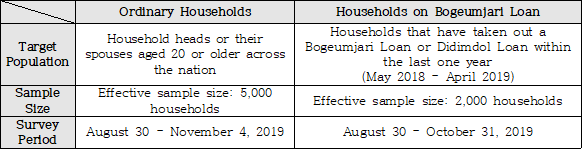

Korea Housing Finance Corporation (HF, CEO Lee Jung-Hwan) revealed the results of the 2019 Survey on the Use of Housing Finance and Bogeumjari Loan on March 26, 2020. The annual survey was conducted jointly with a survey agency to study housing finance trends in the nation.

ㅇ Survey Design

ㅇ Characteristics of ordinary households

For ordinary households, 76.8% are found to be married couples, and 50.6% of them are double-income households. The median monthly combined gross income of ordinary households amounts to KRW 3.6 million.

□ Trends in the use of housing finance

ㅇ 36.2% of ordinary households have a home loan*.

The percentage of those currently on a home loan in Gyeonggi Province and Seoul is 49.5% and 42.4%, respectively. The figures are higher compared to other regions. By age group, the figure was relatively high in the age brackets of 40s (47.8%) and 30 or younger (43.1%). By income group, the figure was highest in the fifth quintile group at 52.3%, followed by the fourth quintile group (48.5%). This indicates that the higher the household income, the higher the percentage of those on a home loan. In addition, households on a housing finance product or on a monthly rent scheme, whether guaranteed or not, say that KRW 440,000 is the affordable monthly housing cost based on their monthly income.

* Mortgage loans, jeonse loans (including credit loans taken out to pay a jeonse deposit), collective loans for new apartment homes, etc.

□ Housing finance helps address social issues.

According to the survey, an overwhelming 87.1% of respondents say that easing eligibility requirements for home loans designed for young people, newlywed couples, and multi-children families helps address social issues.

□ Jeonse and monthly rent loan guarantees for youth increases housing stability.

Among the ordinary households surveyed, 68.8% say that guarantees for jeonse and monthly rent loans to young people help reduce housing costs for them. The figure is found to be notably higher among people in their 30s and also single-person households compared to other respondent groups.

As to whether to expand the age range of young people eligible for the guarantee products*, a majority (52.1%) agrees. Asked by how much to expand the current age range, 54.4% said ‘up to 39’.

* The products offer interest rates in the range of 2% for young households aged 34 or younger with KRW 70 million or less in combined annual income. The maximum guaranteed amount for their jeonse loans and monthly rent loans is KRW 70 million and KRW 12 million, respectively.

□ Long-term, fixed-rate, amortized conversion loans keep household debt in check.

Of those surveyed, 81.4% think long-term, fixed-rate, amortized conversion loans* help ease household indebtedness. The figure is particularly high among those living in Seoul and those who do not own a home.

* HF products: Bogeumjari Loan (including Akkim e-Bogeumjari Loan), Didimdol Loan, Conforming Loan, and Deonaun Bogeumjari Loan

□ Bogeumjari Loan is reliable as it is offered by a public institution.

u-Bogeumjari Loan and Akkim e-Bogeumjari Loan users link their satisfaction with their home loan to the loans’ reliability as a loan product offered by a public institution and their amortization feature, which allows borrowers to pay off principal and interest each month.