Policy Support Needs to Be Tailored to the Needs of Housing-Vulnerable Groups

- Date 2020-09-09

- Views 498

Policy Support Needs to Be Tailored to the Needs of Housing-Vulnerable Groups

- Housing Finance Research Institute studies the housing situation of vulnerable groups using cluster analysis

Korea Housing Finance Corporation (HF, CEO Lee Jung-Hwan) unveiled the results of a survey conducted by the Housing Finance Research Institute on the 9th. Entitled ‘The Analysis of the Housing Finance Needs of Housing-Vulnerable Groups,’ the survey explores the specific housing finance needs by each vulnerable group and suggests customized policy measures to meet group-based needs using cluster analysis*.

* A machine learning task of grouping samples using hierarchical clustering and interpreting the clustering results

(Research background) Over the last 30 years, urban residential areas have been mostly redeveloped into apartment complexes, forcing more and more low-income people to move and settle into dilapidated areas in groups.

ㅇ Despite the government’s continued supply of permanent rental and purchase-to-rent homes for low-income and other socially vulnerable groups, difficulties still remain due to a lack of funds and land available for construction.

ㅇ In this context, the survey seeks measures beyond the conventional supply of housing units and welfare benefits, focusing on more fundamental policy approaches that can improve the housing conditions of vulnerable groups.

(Research methods) The survey looked into the everyday lives of the housing vulnerable and their subsequent housing finance needs, classifying them into different clusters with different financial support schemes and proposing support measures tailored to each cluster.

ㅇ Then, the 2,000 samples were grouped into four clusters* depending on their housing condition and subsidy receipt status.

* 1. Single-room unit dwellers not on the Subsidy, 2. rooming-house dwellers not on the Subsidy in non-metropolitan areas, 3. rooming-house dwellers on the Subsidy in Seoul, 4. rooming-house dwellers on the Subsidy in metropolitan areas adjacent to Seoul

(Research results) Most of the housing vulnerable are exposed to housing welfare loopholes.

ㅇ Among those surveyed, 14.9% of single-room unit dwellers and 65.5% of rooming-house dwellers live on the National Livelihood Security Subsidy.

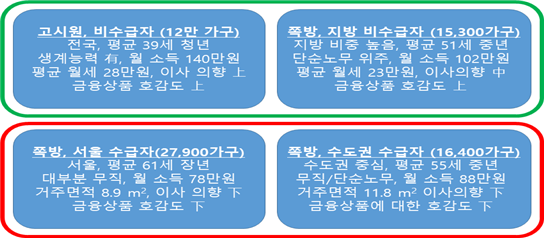

ㅇ Key characteristics of housing vulnerable clusters (The household numbers below are the figures estimated from the cluster analysis.)

좌상: Single-room unit dwellers not on the Subsidy (120,000 households)

Average sample: A 39-year old adult (living anywhere in the nation)

Able to meet basic needs, 1.4 million won in monthly income, 280,000 won a month in rent, highly willing to move out of current residence, and highly willing to take out a financial product

우상: Rooming-house dwellers not on the Subsidy in non-metropolitan areas (15,300 households)

Average sample: A 51-year old adult (predominantly living in non-metropolitan areas)

Manual jobs, 1.02 million won in monthly income, 230,000 a month in rent, moderately willing to move out of current residence, and highly willing to take out a financial product

좌하: Rooming-house dwellers on the Subsidy in Seoul (27,900 households)

Average sample: A 61-year old senior (living in Seoul)

Mostly unemployed, 780,000 won in monthly income, 8.9m2 of living space, least willing to move out of current residence, and least willing to take out a financial product

우하: Rooming-house dwellers on the Subsidy in metropolitan areas adjacent to Seoul (16,400 households)

Average sample: A 55-year old adult (predominantly living in non-Seoul metropolitan areas)

Unemployed or employed for manual work, 880,000 won in monthly income, 11.8m2 of living space, least willing to move out of current residence, and least willing to take out a financial product

※ Rooming-house-dwelling and subsidy-receiving Seoul cluster: 78.7% in Seoul

※ Rooming-house-dwelling and subsidy-receiving non-Seoul Metropolitan cluster: 70.5% in non-Seoul metropolitan areas

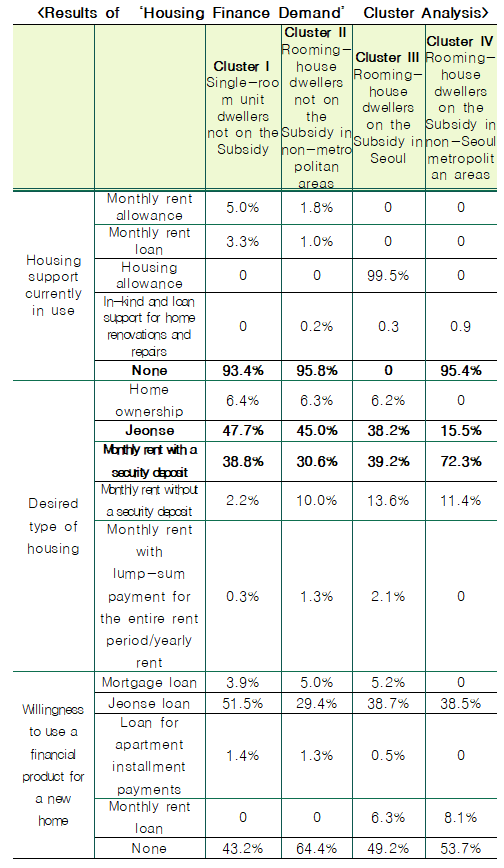

ㅇ The most-preferred housing mode by the housing vulnerable is jeonse rental or monthly rental with a security deposit.

ㅇ A majority of housing-vulnerable groups do not have any knowledge of currently available housing support measures or how to apply for them, suffering from information gaps.

ㅇ Most of the housing-vulnerable populations, except for Cluster III, responded that they do not receive housing support. To boost their information search skills and willingness for better living conditions, measures to address this information asymmetry must be drafted along with housing finance policies.

ㅇ Clusters I and II, not on the Subsidy and capable of meeting basic needs at relatively higher levels, show a high level of willingness to move out of the current residence and use a financial product for a new home. In fact, an average of 46.4% of Clusters I and II responded that they prefer Jeonse homes, indicating that jeonse loans or other rent loan products can be a proper policy response to their needs.

ㅇ Clusters III and IV, relatively more vulnerable rooming-house dwellers on the Subsidy, are found to be strongly willing to settle down in the current residence and, as a result, unwilling to take out a financial product. A build-to-rent policy can be a proper solution for these groups.

(Policy suggestions) Housing policies should be customized to the needs of housing-vulnerable groups depending on their residence type and subsidy receipt status.

ㅇ As those not on the Subsidy prefer jeonse homes and need rent loans more than the others, jeonse rental through a housing intermediary service agency, such as the Rooming-House Counseling Center, can be a good policy response for them.

- Rooming-House Counseling Centers and local welfare centers (intermediary service agencies) have already established strong trust with vulnerable people through continued counseling and support services. Well aware of their current living conditions and lifestyle patterns, these intermediary service agencies can provide them with support services, assisting them in selecting a financial institution for a loan and offering information on financial products more tailored to their financial needs.

- The agencies, in particular, can provide vulnerable groups with a comprehensive support service that covers tasks from new home searches to loan payment management.

ㅇ As those on the Subsidy prefer monthly rent with a security deposit, it would be ideal to supply them with rental homes. To ensure the sustained supply of rental homes, it can be a good idea to convert empty properties into rental homes.

- A purchase-to-rent option enables public institutions to purchase or acquire vacant homes and unused spaces in dilapidated neighborhoods, convert them into rental homes, and offer them to vulnerable people in the same area. This option prevents the emergence of slums and also offers opportunities to carry out various projects that can serve the public interest of the area.

HF Housing Finance Research Institute Researcher Choi Young-Sang, who carried out the survey, said, “If the government can develop policy measures customized to the specific characteristics and home financing needs of different housing-vulnerable groups based on the results of this survey, they will be of great assistance in helping these disadvantaged people achieve self-reliance through decent housing. Along with these measures, we also need to create policy measures to invigorate their willingness to work because most of the people are day laborers working in poor working conditions.”