HF Leverages ESG Bonds to Support the Housing Stability of Low-Income People

- Date 2021-03-25

- Views 400

HF Leverages ESG Bonds to Support the Housing Stability of Low-Income People

- This year, HF set to issue KWR 40 trillion in ESG bonds to improve the structural soundness of household debt

Korea Housing Finance Corporation (HF, CEO Choi Jun-Woo) announced on the 25th that it will issue around KRW 40 trillion in ESG bonds* this year in Korea and abroad.

* ESG bonds are a debt financing instrument to raise funds for projects that can contribute to social value creation in terms of their environmental, social, and governance impact. HF-issued ESG bonds are a type of social bonds.

As part of its efforts to improve the structural soundness of the nation’s household debt and the housing stability of low-income people through inclusive finance, HF will issue approximately KRW 10 trillion in ESG bonds each quarter this year. Furthermore, it is set to expand its long-term bond issuance to supply state-sponsored mortgages with a term of 40 years or more.

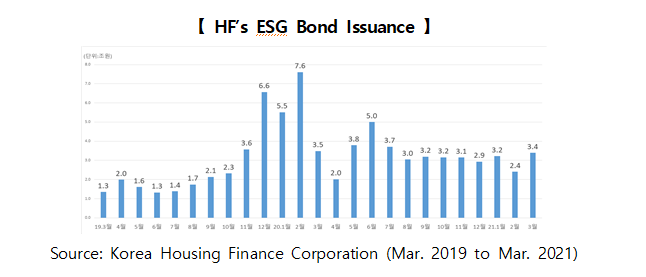

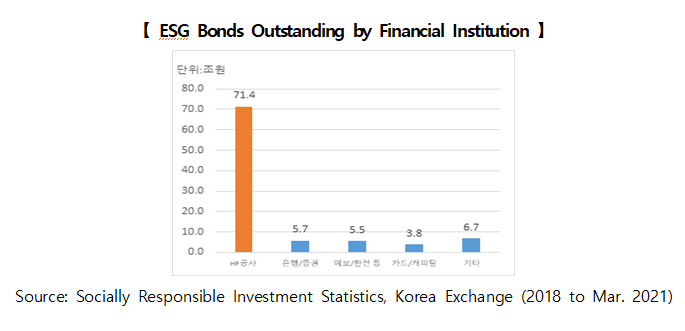

From March 2019 to March 2021, HF issued a total of KRW 79.6 trillion in ESG bonds (KRW 71.4 trillion outstanding), raising funds to provide long-term, fixed-rate mortgages to some 610,000 households at a low interest rate. This marks the largest ESG bond issuance in Korea. Last year, HF issued KRW 46.5 trillion in ESG bonds, accounting for around 83.8% of the nation’s total ESG bond supply (KRW 55.6 trillion).

In addition, HF has made a significant contribution to building the infrastructure for promoting the nation’s ESG bond market. More specifically, it took part in establishing guidelines on the operation of the Socially Responsible Investment Segment of Korea Exchange and enthusiastically suggested and helped create incentives for ESG bond issuance, such as the exemption from listing fees. Thanks to these endeavors, the ESG bond market, which has long been overlooked by companies because of its cumbersome issuance procedures, such as ESG bond verification, and additional issuing costs, will attract more corporate issuers. This, in turn, is expected to have a positive impact on the promotion of the ESG bond market.

The recent growing interest in ESG bonds from both potential issuers and investors is based on their unique merits. Corporate issuers can raise funds at a low rate for their socially responsible projects and thereby contribute to social value creation. At the same time, investors can enjoy great investment stability from ESG bond-issuing companies that can earn more credibility from their ESG bond activities in addition to their financial performance.

An HF official said, “This year, bond markets are likely to experience continued fluctuations in the aftermath of the COVID-19 outbreak, as they did last year. By diversifying our methods of raising funds in response to this market uncertainty and developing market-oriented issuing strategies, HF will continue to raise funds at a low rate.”