HF Expands Monthly Payment Options to Home Pension Subscribers

- Date 2021-07-28

- Views 295

HF Expands Monthly Payment Options to Home Pension Subscribers

- ‘High-low Payment’ for larger initial payment to fill the income gap after retirement

- ‘Periodic Increase’ for every three years against inflation and diminishing purchasing power

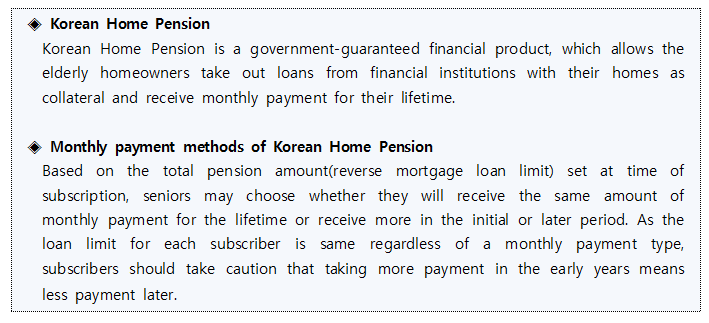

Korea Housing Finance Corporation(HF, CEO Choi Joon Woo) announced July 28 that it releases new Korean Home Pension products on August 2, in order to better support stable livelihood of seniors with more options to choose monthly payment for home pension, depending on their economic activities or financial situation.

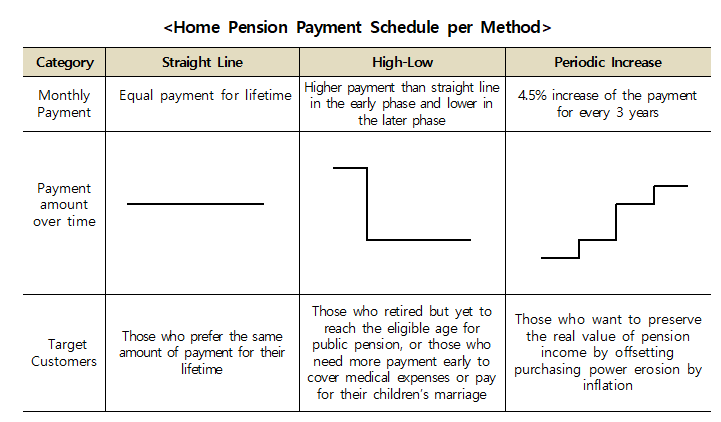

HF identified customer needs on the monthly payment methods from the data collected from various channels and decided to newly release the ‘High-Low Payment’ type under which subscribers can choose periods of higher payment among three, five, seven and ten years, along with the ‘Periodic Increase Payment’ type, of which payment goes up periodically to offset the erosion of purchasing power by inflation, while maintaining the ‘Straight Line Option’, which was found to be preferred by many subscribers.

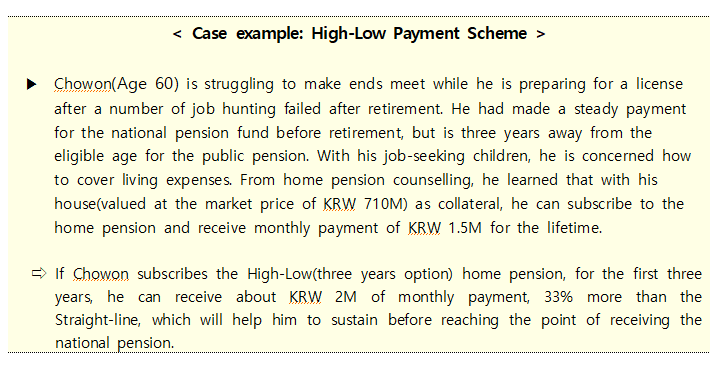

① High-Low Type ☞ For those with income gap or possibly higher living expenditures at the early stage of subscription

Those who choose the High-Low home pension can receive higher payment at the early stage of subscription, and may choose the high to low switch period among three, five, seven and ten years. For example, when a 60-year old owning a house of KRW500M opts this type with five years of higher payment, he will receive KRW 1,362,000 for the first five years of subscription, which is about 28% larger than payment under the Straight Line, and receives KRW 953,000 or about 70% of the initial payment for his lifetime, from the sixth year. This type of payment can benefit those faced with income gap between retirement and other public pension, such as national pension, and seniors in advance years who expect more expenditures for medication, etc.

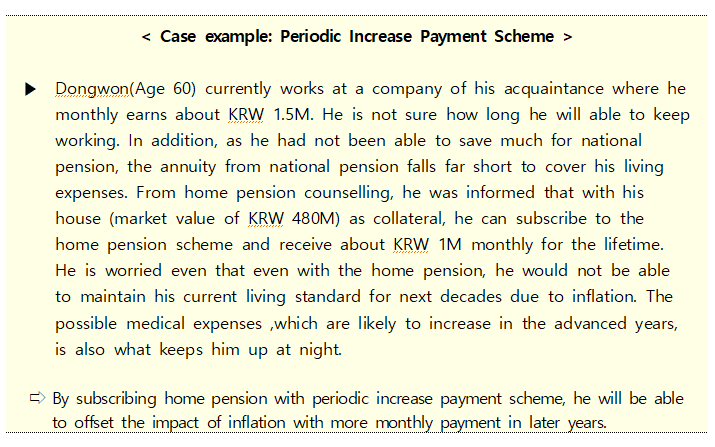

② Periodic Increase Type ☞ For those concerned about inflation or larger medical costs in later years

Under the Periodic Increase Payment scheme, the monthly payment goes up by 4.5% every three years after initial payment. For example, when a 60-year old senior with a collateral house of KRW 500M opts this type, the initial payment will start from KRW 878,000, which is less than the monthly payment of KRW1,061,000 under the Straight Line scheme. The payment, however, begins to exceed that of the Straight Line when he gets 75 years old, with KRW1,094,000 annuity. From 90 years old, he can receive KRW 1,363,000. Accordingly, the Periodic Increase Scheme will be useful for subscribers who are concerned about diminishing purchasing power due to inflation or who seek to prepare for the future with the likely increase in medical and other living expenses.

HF CEO Choi said, “With the newly released home pension products, seniors now can choose a payment scheme that best meets their individual needs, and benefit from the pension for stable livelihood in advanced years. We will pay a close attention to the voices of the public and make continuous improvement of the home pension program to better meet their needs.”

HF stressed, “As there is no difference in the amount of total pension loan limit per se, with only different monthly payment over time for each payment option, seniors should have a clear understanding on their financial situations before choosing. For more information, please visit HF website(www.hf.go.kr) or call HF Call Center (1688-8114).”