New Home Pension Products for Fewer Worries and Greater Relief

- Date 2021-06-08

- Views 328

New Home Pension Products for Fewer Worries and Greater Relief

- ‘Trust-Type Home Pension’ where the rights to Home Pension payments automatically go to a surviving spouse

- ‘Seizure Prevention Home Pension Passbooks’ also available to help protect funds for the minimum cost of living (up to KRW 1.85 million) from seizure

Korea Housing Finance Corporation (HF, CEO Choi Joon-Woo) stated on the 8th that it will launch the ‘Trust-Type Home Pension’ scheme and introduce ‘Seizure Prevention Home Pension Passbooks’ on the 9th to ensure stronger payment protection for Home Pension subscribers.

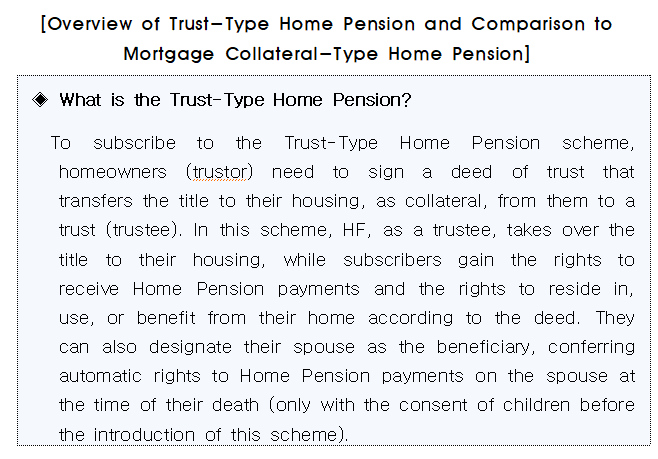

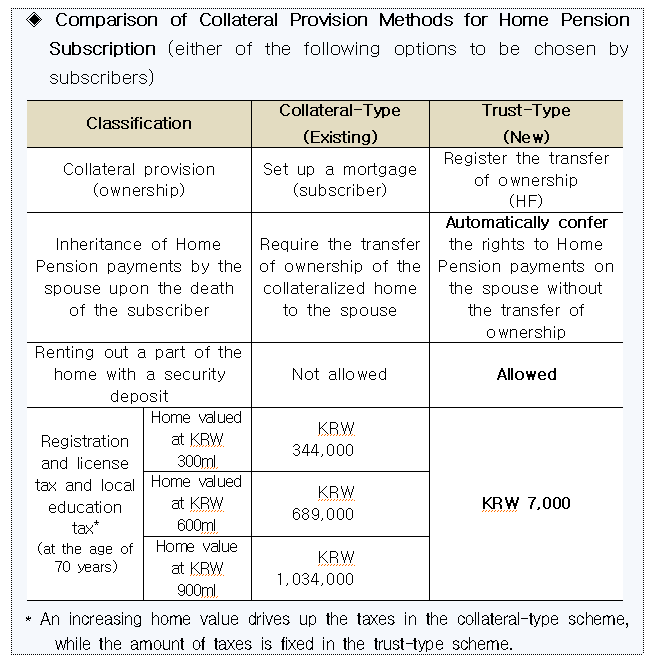

HF stresses that the Trust-Type Home Pension scheme has the following advantages: ① it automatically grants the surviving spouse the rights to Home Pension payments upon the death of a subscriber; ② it is available to homeowners who rent out part of their house with a security deposit; and ③ it significantly reduces costs such as the registration and license tax paid to provide collateral at the time of subscription and succession compared to the existing mortgage collateral type.

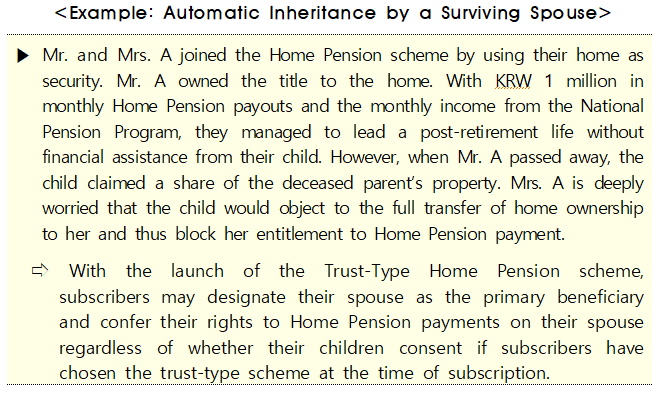

① The surviving spouse can enjoy a stable stream of Home Pension payments without the transfer of ownership

The existing Collateral-Type Home Pension scheme requires the transfer of full ownership of the collateralized home to the surviving spouse to ensure that the spouse inherits the rights to Home Pension payments. This requires the consent of any children who are also in line to inherit the rights. Accordingly, if any such child does not waive the beneficiary right, the spouse cannot receive Home Pension payments.

To address this issue, HF has introduced the Trust-Type Home Pension scheme, where the rights to Home Pension payments automatically go to a surviving spouse nominated as the primary beneficiary under the deed of trust without the transfer of home ownership, supporting subscriber spouses to enjoy a financially stable retirement.

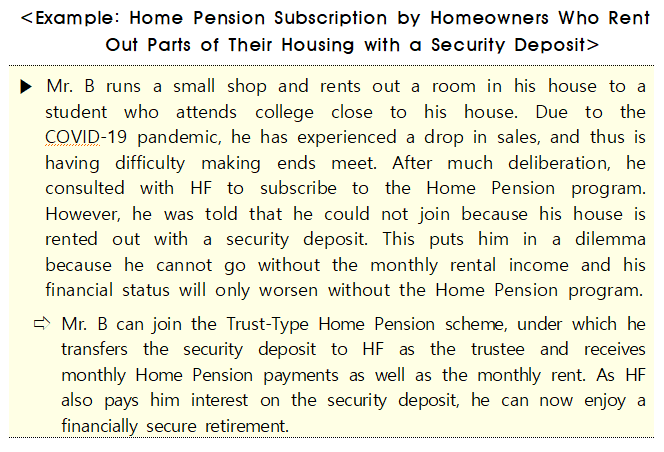

② Home Pension is readily available to homeowners who rent out part of their single-unit home, offering them an additional stream of income

Under the existing Home Pension scheme, homeowners who rent out part of their housing with a security deposit could not subscribe to the Home Pension program. The newly introduced trust-type scheme allows them to join the program if they transfer the security deposit to HF as the trustee, which offers them interest payments thereon at the level of the interest on fixed deposits and creates another stream of post-retirement income in addition to Home Pension payments.

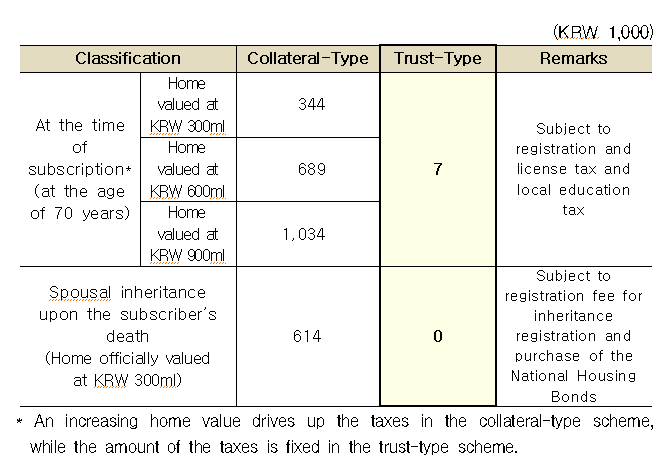

③ Fewer Subscription and Spousal Inheritance Costs

The trust-type scheme has lower registration and license tax rates compared to the existing collateral-type scheme. Moreover, it does not require the transfer of home ownership, which entails inheritance registration, change in collateral security, and other procedures upon the death of the subscriber, thus reducing many costs.

In addition, as part of its efforts for stronger payment protection, HF is introducing seizure prevention passbooks for Home Pension subscribers, ensuring that, of the total monthly payout, the minimum cost of living (up to KRW 1.85 million) set forth in the Civil Execution Act is transferred into a seizure prevention passbook known as a “Home Pension Safeguard Passbook”. This allows subscribers to secure their Home Pension payments no matter what happens in their retirement accounts.

HF CEO Choi Joon-Woo said, “The launch of the Trust-Type Home Pension scheme and the Home Pension Safeguard Passbook lessens the worries of the surviving spouse living alone after the death of the subscriber and offers greater relief by ensuring a steady flow of Home Pension payments under any circumstances. HF will make continued efforts to expand the service options for our customers and improve our product value and customer convenience.”

An HF official said, “As customers have different situations and different needs, they can choose the right collateral provision method between the collateral-type and trust-type schemes. Please visit the HF webpage (www.hf.go.kr) or call us at 1688-8114 for more information.”