2020 Survey Report on Housing Finance and Bogeumjari Loans

- Date 2021-05-26

- Views 320

2020 Survey Report on Housing Finance and Bogeumjari Loans

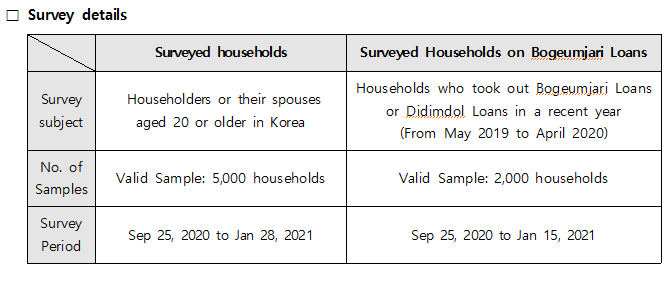

Korea Housing Finance Corporation (HF, CEO Choi Joon Woo) released ‘2020 Survey Report on Housing Finance and Bogeumjari Loans’ on May 26, conducted in cooperation with a survey agency to look into the housing finance use in Korea.

HF has surveyed the public awareness and identified their needs on housing finance through the annual survey, which looks into usage of housing finance, intention on purchasing a house or using housing finance, and use of Bogeumjari Loans or Didimdol Loans, etc.

□ Characteristics of the surveyed households

74.0% of the surveyed householders are married, of which 53.6% are double-income couples, with total average asset of KRW 354.14M and of KRW 3.61M average monthly income.

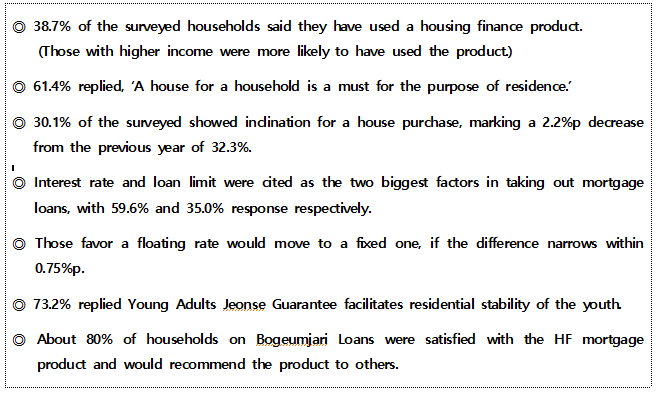

□ Four out of ten the households have used housing finance products*.

38.7% of the surveyed are using housing finance products. By region, Seoul showed the highest use rate with 53.8%, closely followed by Gyeongi province of 51.3%. The higher household income was, the greater use rate of housing finance products was observed. By householder age, those in 40s are the biggest consumers of the housing finance, accounting for 54.2% of the total.

* Refer to mortgage loans, Jeonse loans, including credit loans for Jeonse deposit, and loans for intermediate payment for pre-sale in lots, etc.

□ Six out of ten households believe a house for a household is a must for residence.

61.4% of the surveyed believe there should be at least one house for a household for residence, while 18.5% replied they would rent a house in a form of Jeonse or monthly rent, assuming stable residential environments, and 11.2% said homeownership for a purpose of other than actual residence is necessary, namely, for investment.

□ Three out of ten households say they have an intention to purchase a house.

Those revealed an inclination of house buying was 30.1%, a 2.2%p decrease from previous year. By householder age, those under 30s showed the highest inclination of home-buying with 56.5% response. In the meantime, 52.9% of non-homeowners said they have an intention to purchase a house going forward.

□ Households on mortgages pointed out the interest rate as the most important factor(59.6%) in taking out the loans. The loan limit and the borrowing period came in as the second and third important factors to consider, with 35.0% and 26.1% reply rate for each.

For reasons to take out the mortgages, the interest rate, the loan limit, and the borrowing period were cited as relatively highly important factors, with 59.6%, 35.0% and 26.1% reply respectively. In addition, the interest rate and the loan limit were cited relatively high as reasons for taking Bogeumjari Loans and Didimdol Loans.

□ The households who favor floating rate answered they would move to a fixed rate if the difference with the fixed rate is narrowed within 0.75%p.

More households who prefer a variable rate would move to a fixed rate when the difference comes within 0.75%p. Likewise, those who favor a fixed rate said they would reverse their preference when the difference widens more than 0.75%p.

□ Seven out of ten households think the Young Adults Jeonse Guarantee helps the youth seeking residential stability.

73.2% of the surveyed replied Young Adults Jeonse Guarantee product is more of use than Young Adults Monthly Rent Guarantee, for residential stability of the youth. For its reasons, 42.7% said Jeonse contracts are more conducive to building assets and saving costs, compared with monthly rent contracts, while 24.3% pointed out the interest rates for Jeonse loans are lower than monthly rents or loans for the rent.

□ Eight out of ten Bogeumjari Loans borrowers are satisfied with the loan product and willing to recommend it to others.

Those who replied to be highly satisfied with the HF mortgage loan products amounted to 80.7%, recording a 3.3%p year-on-year increase. Borrowers of u-Bogeumjari Loans and t-Bogeumjari Loans pointed out the ‘trustworthiness of the public institution’s product’ as the biggest reason for satisfaction(80.9% of reply rate). In the meantime, the long borrowing period of up-to 30 years of maturity was cited as the second biggest reason for satisfaction with 73.3%, followed with no additional interest burden regardless of market rate hike, which recorded 73.1% of reply. In addition, 82.0% of respondents said they are willing to recommend the HF housing finance products to others, which marks 3.2%p year-on-year increase.

□ For “2020 Survey Report on Housing Finance and Bogeumjari Loans‘, visit HF website, www.hf.go.kr