Debtors Now Able to Limit Debt Collection Contacts

- Date 2021-05-03

- Views 283

Debtors Now Able to Limit Debt Collection Contacts

- HF becomes the first financial institution to give debtors the right to request limiting debt collection contacts

- Those delinquent on HF-guaranteed home loans now allowed to request restrictions on contact hours and methods

Korea Housing Finance Corporation (HF, CEO Choi Joon-Woo) announced on the 3rd that it will take measures to reduce ‘delinquency and debt collection burdens’. These measures aim to protect debtors suffering from abusive debt collection practices and help them get back on their financial feet.

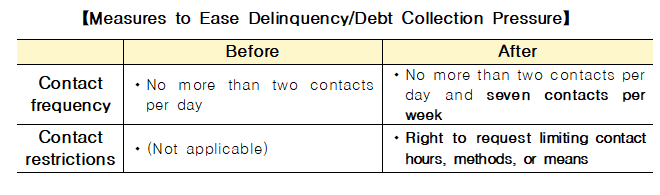

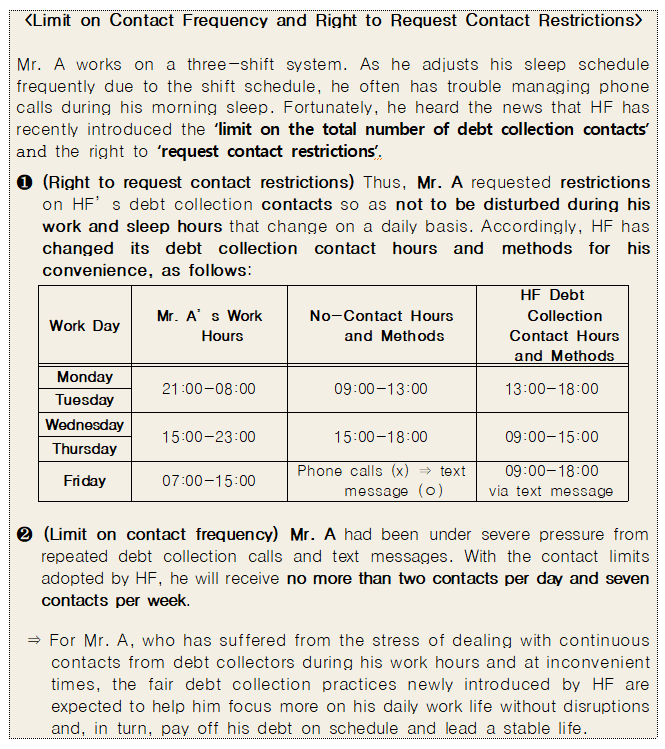

More specifically, for greater fairness in debt collection, HF will grant those delinquent on HF-guaranteed home loans, including jeonse loans, the right to ▲ limit the total number of debt collection contacts and ▲ request contact restrictions.

Accordingly, debt collectors will not be allowed to contact* them more than twice per day and seven times per week. Any contact initiated by a debtor or by a debt collector as agreed to, requested, or needed by the debtor does not count towards the contact total.

* An act of contacting debtors via telephone, email, text message, mail, visit, etc.

In addition, HF gives debtors the right to request a specific limit on the hours or methods of debt collection contacts. As a result, debt collection contacts will be allowed within 4.5 hours of HF’s business hours of 9 a.m. and 6 p.m.

An HF official said, “We will reduce any stress that those with debt repayment problems experience from excessive debt collection pressure. To help them lead a stable life, we will take the lead in establishing a culture of fair debt collection.”

As part of its efforts for inclusive finance, HF has also cut the interest rate charged on HF-guaranteed home loans in arrears below 5.0%*, which is lower than that offered by commercial banks, to reduce repayment burdens.

* From January to March, 2021, the interest rates that commercial banks charge on jeonse loans in arrears average 5.5%.