HF adjusts Bogeumjari Loan Rate for October

- Date 2021-09-24

- Views 375

HF adjusts Bogeumjari Loan Rate for October

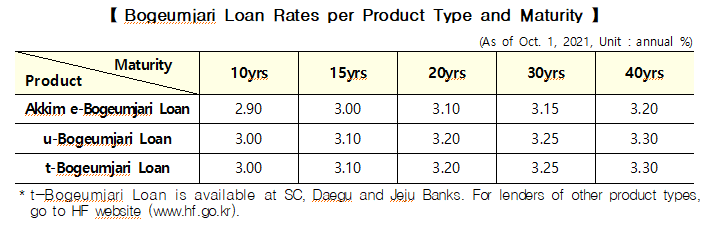

- The lowest annual rate of 2.90% is available per product type and maturity.

- Borrowers should look into if they are eligible for a low-income household program or other forms of a preferential discount.

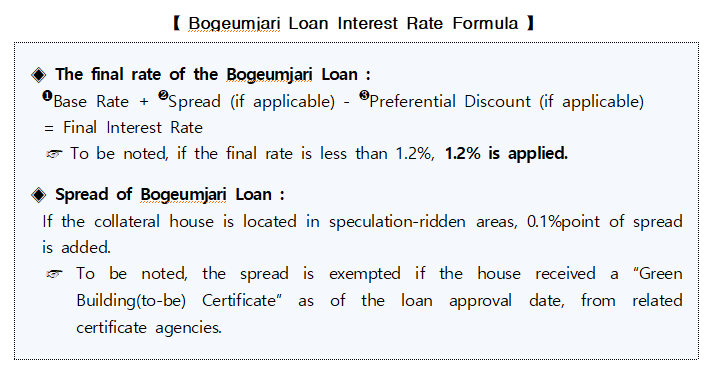

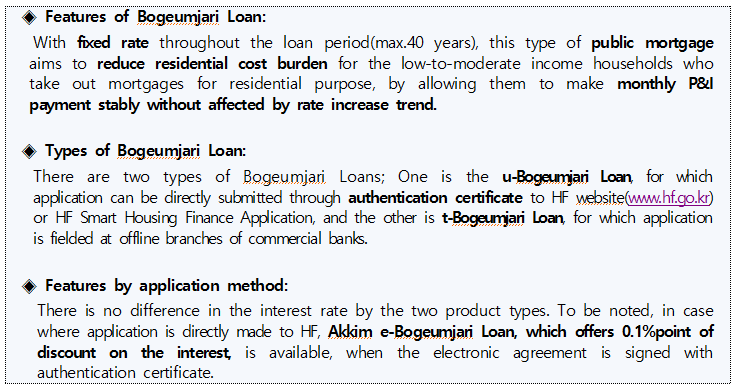

Korea Housing Finance Corporation(HF, CEO Choi Joon Woo) stated on September 24 that it will increase the annual interest rates by 0.20%point for October on Bogeumjari Loan product, its long-term, fixed-rate, amortizing mortgage loans.

Accordingly, from the loans of which application is completed on Oct 1, the interest rates of u-Bogeumjari Loan and t-Bogeumjari Loan will range from 3.00%(10-year maturity) to 3.30%(40-year maturity), whereas Akkim e-Bogeumjari Loan interest rate will be applied with 2.90%(10-year maturity) and 3.20%(40-year maturity), 0.1% point lower than the other two loan types. The annual rates will be fixed throughout the loan period.

HF said, “Affected by government bond rate increase and other upward pressures, the Bogeumjari Loan rates had to be adjusted. Those who complete the loan application by the end of September can be applied with the current rate before the increase.”

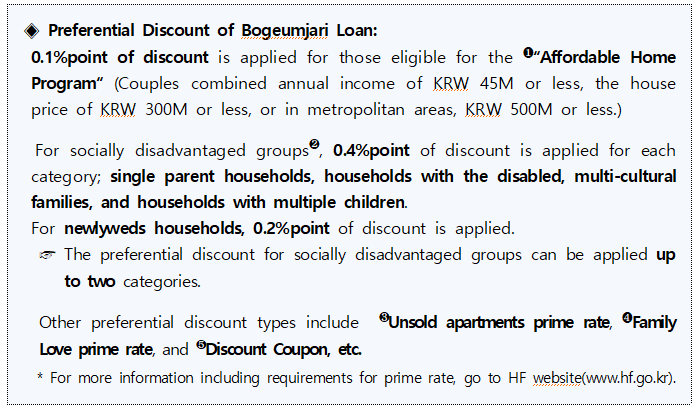

In the meantime, the ‘Affordable Home Program’ for low-income brackets, released on September 27, offers 0.1%point discount on the Bogeumjari Loan rate. Households with combined annual income of KRW45M or less are eligible for the program and the discount can be applied when the house price is less than KRW300M (or KRW500 or less in the metropolitan areas*.)

* When the collateral house is located in Seoul, Gyenggi or Incheon, house price limit is KRW 500M.

It should be noted, however, whereas Bogeumjari Loans with 10 to 30 years of maturity do not come with particular restriction, the Bogeumjari Loan with 40-year maturity are confined to those who are 39 years or younger, or couples whose marriage registration date goes back to less than 7 years, or who are getting married within 3 months from application.

HF added, “The final rates by product and maturity after applying additional preferential or spread are sustained throughout the loan period. For more information on the terms or features of the loans, please visit HF website(www.hf.go.kr) or call HF Call-Center(1688-8114).”

“Furthermore, in general, longer maturity means less monthly repayment, but as longer maturity is applied with a higher base interest rate, the total amount of interest to be repaid during entire redemption period increases. Therefore, applicants should make a careful examination on their economic and financial situations before deciding taking out of the Bogeumjari Loan, the loan amount, a maturity period and a redemption method.”