Bogeumjari Loan users now subject to annual monitoring of additional home purchases

- Date 2022-01-10

- Views 298

Bogeumjari Loan users now subject to annual monitoring of additional home purchases

- They now face more frequent monitoring of additional home purchases (3 years to 1 year) and a shorter time period for additional home sell-off (1 year to six months)

- This stringent control aims to focus HF’s limited funding on low- and moderate-income families without housing and those with a real housing need and, in turn, promote inclusive finance

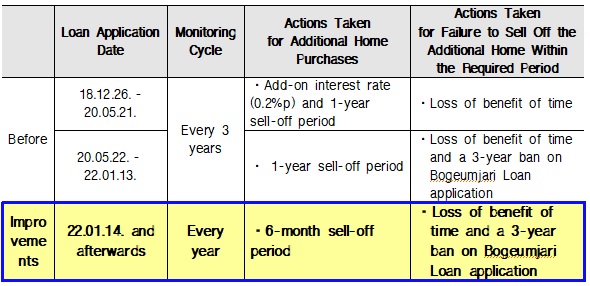

From the 14th, new Bogeumjari Loan applicants are subject to annual monitoring of additional home purchases and a six-month sell-off requirement if they are found to have purchased an additional home. Previously, the monitoring frequency and required sell-off period have been set at three years and one year, respectively, but are now reduced to one year and six months.

Korea Housing Finance Corporation (HF, CEO Choi Joon Woo) stated on January 10, 2022, that as part of its effort to focus limited Bogeumjari Loan funding on greater housing stability for low- and moderate-income households with a real housing need, it has decided to reduce the monitoring cycle and the required sell-off period.

HF monitors Bogeumjari Loan users on a regular basis to check whether they have purchased another home in addition to their primary home secured as collateral. If they are found to have done so, they are required to sell the additional home within a certain period of time. If they fail to sell it, HF takes follow-up actions such as declaring their loss of benefit of time and a three-year ban on Bogeumjari Loan application.

【Major Improvements in Additional Home Purchase Monitoring】

HF CEO Choi said, “These improvements aim to quickly collect Bogeumjari Loan funds from existing users who have bought additional homes, which is against the overall purpose of this state-sponsored mortgage loan, and use the collected funds to offer loans to low- and moderate-income households without housing. This allows us to dedicate our limited funds to those in this income bracket and in real need of home.” He also added, “HF will continue to focus more on promoting housing stability for these low- and moderate-income households with a real housing need and thereby expand inclusive finance.”

In relation to these changes, HF will offer more SMS text pre-notifications at the time of loan approval, execution, and every monthly principal payment.