HF Attracts More Foreign Investment in MBS

- Date 2021-11-29

- Views 326

HF Attracts More Foreign Investment in MBS

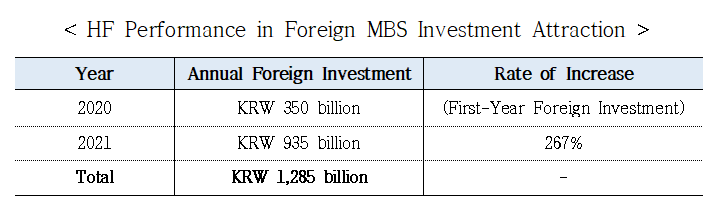

- Foreign investments in MBS this year stood at KRW 935 billion, a three-fold increase from a year earlier

- HF introduces open bidding to draw frequent foreign investments in South Korean MBS

- HF uses funds from MBS issuance to support low- and moderate-income home loan borrowers

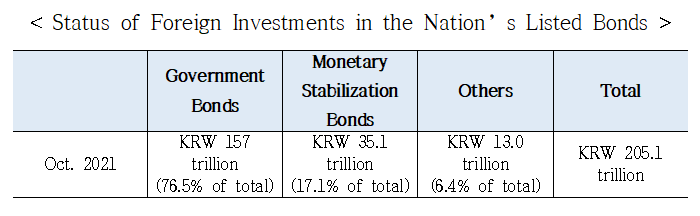

Korea Housing Finance Corporation (HF, CEO Choi Joon-Woo) stated on November 29, 2021, that this year’s foreign investments in HF-issued mortgage-backed securities (MBS) reached KRW 935 billion. The figure represents a nearly three-fold increase from a year earlier and is a truly remarkable achievement for HF given that 94% of foreign investments in the nation’s bond market this year were skewed to government bonds.

According to HF, such a notable increase in foreign MBS investments was possible because it has created a more favorable MBS investment environment for foreigners this year by introducing an open bidding system in which foreign investors have an investment cap assigned to their respective country and can then make frequent investments in South Korean MBS. This was part of HF’s efforts to address the key shortcoming of its previous non-competitive bidding process: restricting foreign investors to a one-time investment in MBS only after obtaining their MBS investment quota through a separate agreement with HF.

HF further stated that the increase was also made possible by its efforts to publicize HF’s MBS to foreign investors familiar only with Korean government bonds by ▲ increasing their understanding of the workings of its MBS business, such as its process of setting MBS interest rates and its bidding process, and ▲ promoting the advantages of MBS to encourage them to switch some of their investments in government bonds to MBS.

Regarding this, an HF official said, “It is meaningful because it offers foreign investors a stepping stone towards sustained investment by allowing them to participate in our MBS bidding under the same conditions as those for domestic investors.” An official from a foreign investment firm commented, “The strength of HF’s MBS lies in its high yields while being as stable as government bonds. Based on this MBS investment experience, we will consider setting our annual HF MBS investment cap and participating in HF-led MBS bidding continuously in the future, just as we have been doing with Korean government bonds.”

Recognizing that foreign investments have been made exclusively in short-term bonds with fixed maturities for the purpose of foreign exchange hedging, HF issued Straight MBS with 1-, 2-, 3-, and 5-year maturities* last September for the first time. Before the Straight MBS, a call option was not embedded only in MBS with a maturity of three years or less, but the minimum maturity threshold has been raised to five years, giving more choices to foreign investors.

* With the weighted average issuance rate of 1.875%; KRW 540 billion in total volume issued (on September 17, 2020)

HF CEO Choi Joon-Woo commented, “The total volume of our MBS issuance this year reached around KRW 32 trillion as of this November, accounting for the third-largest share of the nation’s total listed bond issuance following monetary stabilization bonds and government bonds. The funds from our MBS issuance are used to support low- and moderate-income mortgage borrowers in need of their own home.” CEO Choi stressed that HF will grow into a global housing finance institution by continuing its foreign investment attraction efforts and thereby diversifying its funding sources.